Drivers of upturn in forestry industry lie beyond China

The value of New Zealand’s forestry exports to China has risen to record levels during 2013. However, to understand the full story behind this success, one must also look beyond China’s borders and examine the positive effect that rising US construction activity is having on global forestry demand.

As China rebalances away from investment-led growth towards more of a consumption-led model, there have been significant changes in China’s demand for resources and, in turn, world commodity prices. As a rule of thumb, the world prices of consumable products (such as agricultural goods) have risen, while the prices of commodities better suited to an investment model (such as minerals) have fallen. We have covered off this issue in more detail in Asian rebalancing: good, or a necessary evil?.

However, as with any rule, there are always exceptions – and in this case an exception has been the forestry sector. According to ANZ’s commodity price index, world forestry spot prices rose by 16% over the year to August. Given that timber and logs are typically more associated with building investment, this trend appears to be at odds with our view on the relationship between commodity prices and Chinese rebalancing. To get to the bottom of things, and see what other factors may be at play in international forestry markets, let’s begin by breaking down the performance of New Zealand’s forestry sector.

The value of New Zealand’s forestry exports increased by 10% over the year to June 2013, to reach a record level1. This growth was driven by a large increase in volumes, particularly for timber and unprocessed logs (up 13%), while received forestry prices were relatively steady (down 0.7% in New Zealand dollar terms).

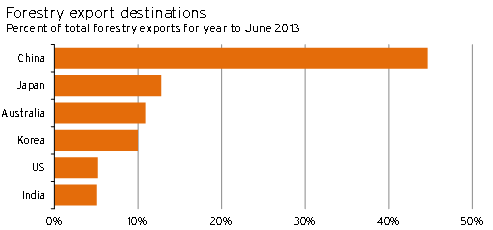

The six biggest buyers of New Zealand’s forestry exports over the past year were Australia, China, India, Japan, Korea, and the US (see Graph 5.7). Collectively, these nations purchased 91% of New Zealand’s forestry exports.

Graph 5.7

Of these markets, the key contributor to the increase in New Zealand forestry exports over the year to June 2013 was China (up 37%). This buoyancy has been surprising, given that economic growth in China has sat below 8.0%pa for the past five quarters (compared with growth above 9.0%pa throughout 2011), and that growth in Chinese imports of most hard commodities has eased back.

Exports of forestry products to Korea and the US also climbed over the past year (up 7.9% and 4.0% respectively), while exports to Japan, Australia, and India all fell (down 8.7%, 7.6%, and 6.5% respectively). Falling forestry exports to the latter three nations was not unexpected – Japanese demand has eased since its post-tsunami boost the previous year, while economic growth in both the Australian and Indian economies is slowing. Little can be read into the Korean result, as forestry exports to Korea tend to bump around a bit, and demand in Korea usually follows rather than leads its neighbours.

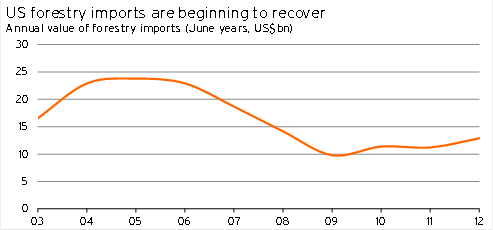

The US result, on the other hand, makes for more interesting interpretations. Although the magnitude of the lift in New Zealand’s forestry exports to the US was small, it was the first positive growth since the US property market collapsed in 2008. The latest lift is being driven by sustained signs of rebounding US construction activity. With this upturn in mind, and the immense scale of the US market, it is important to examine what effect US demand may be having on international forestry markets.

Over the year to June 2013, imports of forestry products into the US rose by 23%, to their highest level since 2008. This lift in demand has been driven by rising construction activity, with the volume of US housing starts in the June quarter climbing 18% from a year earlier, to levels not seen since 2008.

Graph 5.8

This additional US forestry demand has indirectly helped New Zealand’s forestry exports to China in two ways. Firstly, most of this increase in US demand is being met by Canada, whose foresters are focusing their efforts on exporting to the US instead of selling to China. Secondly, the additional US demand is putting significant upward pressure on world forestry prices. The remainder of this section elaborates on these two points.

Over the past year, Canadian forestry exports to the US rose by 33%. This rapid growth saw Canada’s share of US forestry imports rise from 48% to 52% over the year. From Canada’s perspective, the close proximity of the large US market and the existence of free-trade agreements between the two nations makes selling into the US relatively easy. Canada exported 68% of its forestry products to the US over the past year (up from 63% a year earlier), compared with a mere 14% to China (down from 15% last year).

As demand for forestry products in the US has risen, so too have prices paid. Over the first half of 2013, monthly US forestry import prices averaged 5.3% more than their December 2012 level. This lift in American forestry prices came despite the US dollar appreciating against the currencies of most of its key trade partners, including some 5% against the Canadian dollar by June.

Given these rising prices in the US, there has also been a corresponding increase in world spot forestry prices (up 16% over the year to August). This increase is not surprising when one considers that the US is the world’s biggest consumer of forestry products. According to estimates from the South Carolina Forestry Commission, the US accounts for around one quarter of the world’s total consumption.

With consensus forecasts currently pencilling in a further 25% increase in the number of US housing starts during 2014, it is likely that demand for forestry products in the US will continue to grow rapidly over the coming year. Of course, this outlook is not without its risks, but given how broad-based the US recovery now seems to be, and how swiftly house prices are recovering, it seems reasonable. This recovering US forestry demand is likely to ensure that upward pressure on world forestry prices remains.

Contributing to this optimistic outlook for world forestry prices is the view that China’s forestry imports will stay elevated, even if growth in total Chinese forestry consumption slows. This belief is driven by the fact that China’s ability to harvest timber domestically appears to be limited. It is very difficult to find official estimates of the amount of wood available for harvest in China, but we do know that efforts by the Chinese government to look after the environment have involved increased measures to protect forest land. Furthermore, official Chinese statistics showed a 0.7% fall in total production of timber in China during 2012. Our view is also supported by RISI (a forestry analysis company), who estimates that China’s forestry deficit (the amount that total demand exceeds domestic supply) was 117m cubic metres in 2010 and is expected to grow to 182m cubic metres by 2015.

But even with expectations of a healthy outlook for China’s forestry import demand and buoyant world prices, it will not necessarily all be smooth sailing for New Zealand’s forestry exports to China. Our forestry exporters remain vulnerable to competing nations, such as Canada and Russia, increasing their focus on the Chinese market. These risks relate more to the medium-term rather than the short-term and are mitigated somewhat by New Zealand’s free-trade agreement with China but, even so, they should not be underestimated.

To round off the outlook for the New Zealand forestry industry, it is important to not only consider foreign demand and supply, but to also quickly assess the domestic forestry industry’s current capacity. Based on estimates from the Ministry for Primary Industries, it appears that there is little scope for increases to the sustainable harvest over the next 1-2 years. Production data shows that there was 28m cubic metres of wood harvested over the past year, compared with a sustainable harvest at present of around 25-30m cubic metres per annum.

With this estimate in mind and, after weighing up all of the above issues affecting the outlook for the forestry sector, our central view is that annual growth in forestry exports will average 1.5%pa over the three years to June 2016, compared with growth of 7.5%pa over the last three years.

But beyond our forecast period, there is scope for much more rapid growth in the forestry industry. By the early 2020s, the MPI projects that 35m cubic metres per year of pinus radiata alone will be available for harvest. This excess of wood is due to large-scale planting in the early 1990s.

The flip side, however, is that many of these forests are tucked away in smaller blocks on farms, which are often geographically dispersed, with the trees frequently located on steeper land. Consequently, the average costs of harvesting and transporting these trees will be high. Hence, forestry prices will need to remain elevated for it to prove profitable for some of these blocks to be harvested.

1 Data for forestry exports used in this article pertains to category 44 in the harmonized system of coding commodities used by Statistics NZ and its peers.