Executive Summary – March 2016 Forecasts

Flagging growth, or unfurling a recovery?

Fears that we’d have to lower flags to half-mast to mourn the demise of the domestic economy during 2016 now seem to be ill-founded. Confidence levels have improved over the last six months, and indicators of the labour market and household spending have been fluttering in the wind. Tourists and immigrants have been flocking to our shores and boosting activity – once they’ve realised that our four-star offering is superior to Australia’s six-star version.

The other big plus over the last couple of months has been some good summer rainfall, ensuring that a drought has not left our agricultural sector hanging limply.

Alongside these positives, we are set for an eggsplosion [1] of new construction activity during 2016. Auckland will be the centre of this pick-up, with strong population growth and the buoyant services sector demanding more housing and commercial space respectively. The government’s contribution to construction should not be overlooked either. Not content with a $26m referendum, Bill English has pledged allegiance to an extra $1bn for more infrastructure spending, and there are plenty of government-funded rebuilding projects in Christchurch that have yet to catch the breeze.

It’s not all rainbow-farting kiwis[2] though. Dairy returns remain weak, and we have further delayed the speed with which we think milk prices will recover – holding below $6/kgms until 2019/20. Uncertainty about the robustness of the Chinese economy has also led us to revise down our forecasts of GDP growth across Asia. If it occurred, a significant credit crunch in China would bring about as much joy to exporters as a glimpse of the Jolly Roger on the horizon.

The lack of inflation, both globally and domestically, has left the Reserve Bank’s monetary settings from early 2015 looking like a deranged cat raking its garden [3]. We expect the official cash rate to be lowered to 2.25% this year, before being hoisted back up to 2.75% during 2017. This standard of low inflation and low interest rates is vastly different to financial market conditions a decade ago, when the OCR was (union) jacked up to 8.25%.

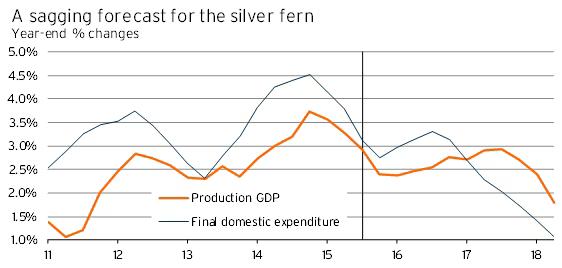

Prospects for the domestic economy over the next 12-18 months look relatively good, but a downturn in construction activity from late 2017 onwards could be the Hone Heke that brings our flagpole crashing down to earth. Unless a kiwi with the power to shoot a laser out of its eye [4] appears, the highly elevated levels of building activity in Canterbury and, more recently, Auckland cannot continue forever. As a result, we forecast that GDP growth will slow from a (red) peak of 2.9%pa in September 2017 to 1.8%pa by mid-2018.

Graph 1.1

Economy relying on new migrants

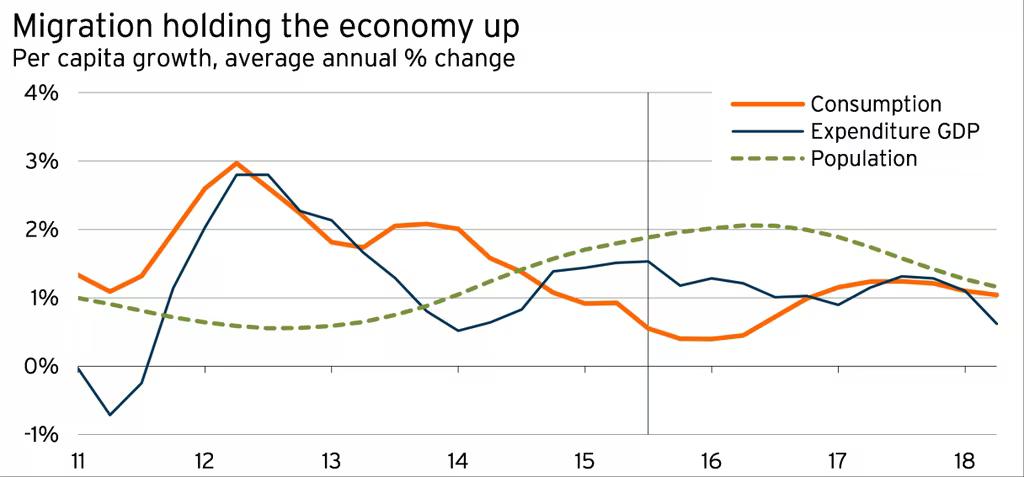

Households’ reluctance to spend became more pronounced during 2015, with per-capita private consumption rising only 0.6% in the September 2015 year – the weakest increase since March 2010. Although plummeting petrol prices would normally lead to a bump up in spending, we believe that economic uncertainty will continue to limit spending growth by firms and households. We expect per-capita spending volumes by consumers to only rise by 1.2%pa in the two years to March 2018. Although there is a surge in building activity in the near term, it will drop back in the March 2018 year – providing a general investment hangover. With individual households and firms unwilling to spend, it will be an increase in customer numbers, through net migration and tourism, that supports average economic growth of 2.7%pa in the two years to March 2018.

Graph 1.2

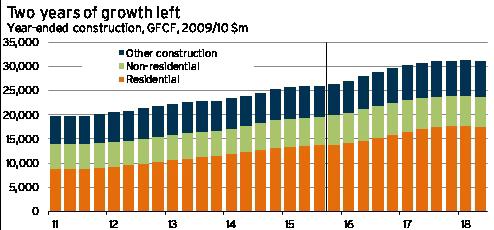

Synchronised upturn leads to record high levels of construction

Although growth in construction activity disappointed during 2015, consents have been rising rapidly and we expect stronger growth in work put in place during 2016. Growth in residential activity will be underpinned by Auckland, with new dwelling consent numbers in the region climbing to almost 14,700pa by June next year. Auckland will also be a significant contributor to 13% growth in the nationwide volume of non-residential activity in the September 2016 year, along with government-funded projects as part of the Canterbury rebuild. Investment in infrastructure is forecast to increase by 11% this year, with roading and irrigation being the main drivers. Already at record high levels, total construction activity is forecast to grow another 18% over the two years to December 2017 before contracting during 2018 and beyond.

Graph 1.3

Vehicle sales ride high on stronger domestic economy

Strong population growth, thanks to high net migration, will keep demand for new and used cars elevated over the next two years. The rebounding domestic economy will bump sales up to new annual highs in December 2016 and September 2017 respectively. As a result, car sales activity will be running well ahead of replacement demand for most of our forecast period, before cooling economic growth sees sales slide to 214,000pa in June 2018. Accelerating construction activity is expected to drive light commercial registrations to 33,000pa in the coming year. Medium and very heavy vehicle sales have come off the boil, but will remain elevated as construction activity, then higher trade volumes push up demand for port-to-city and long-haul transport.

Graph 1.4

[1] https://www.govt.nz/browse/engaging-with-government/the-nz-flag-your-chance-to-decide/gallery/design/12868

[2] https://www.govt.nz/browse/engaging-with-government/the-nz-flag-your-chance-to-decide/gallery/design/2811

[3] https://www.govt.nz/browse/engaging-with-government/the-nz-flag-your-chance-to-decide/gallery/design/10026

[4] https://www.govt.nz/browse/engaging-with-government/the-nz-flag-your-chance-to-decide/gallery/design/3127

Infometrics forecasts are available in full to our subscription clients. If you are interested in our forecasts please contact us.