Auckland: Central Auckland

This article is part of the Regional Hotspots report. To find out more about the report and other hotspots, click here

Highlights

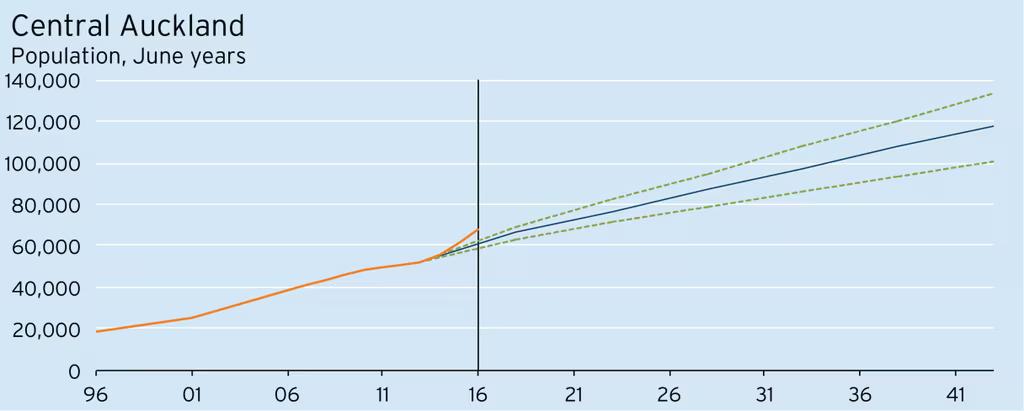

- Population growth 2013-2023: 47% (24,410 people)

- Strong population growth is expected close to the waterfront, particularly in the Wynyard Quarter, which is aimed at the upper-end of the market.

- The international education sector once again shapes as a significant driver behind demand for central city accommodation

- The geographic pattern of business growth in Central Auckland is set to change over the next seven years with the construction of the City Rail Link.

- One of Auckland’s challenges will be ensuring civil infrastructure can handle the demands of a rapidly increasing population in a relatively small area.

Increased densification is a necessary part of Auckland’s development as the city’s population continues to expand. Although a lot of attention has been focused on the development of town centres with higher-density residential components in suburban areas, these pockets of intensive development pale by comparison with the expected growth in the central city’s population over the next decade. The deluge of central city apartment development during the first half of last decade saw the population of our Central Auckland hotspot more than double, from 24,100 people at the 2001 census, to 49,400 by the 2013 census. Sixty percent of that growth occurred in the Auckland Central West and Auckland Central East area units, which lie between the Northern Motorway and SH16 heading down to the port.

Since the 2013 census, very strong population growth has continued in these two area units, with the population in each area unit by June 2016 already exceeding Statistics NZ’s medium projections for 2023. Grafton West and Newmarket’s populations are also running well ahead of expectations, contributing to Central Auckland’s surging population over the last three years.

Although the Auckland Central West and Auckland Central East areas will continue to grow over coming years, that expansion will be somewhat overshadowed by development closer to the waterfront, particularly in the Wynyard Quarter. These harbour-side developments are likely to primarily be aimed at the upper end of the market, appealing to high-income and/or high-wealth households.

As was the case in the late 1990s and early 2000s, growth in the international education sector also currently shapes as a significant driver behind demand for central city accommodation. The convenience of living close to their place of study is complemented by other central city amenities and the lack of any required property maintenance. However, the standard and size of current and future apartment construction is set to be significantly higher than during last decade’s apartment building boom, which resulted in a large number of low-quality and substandard dwellings.

The geographic pattern of business growth in Central Auckland is set to change over the next seven years with the construction of the City Rail Link. Over the last 20-25 years, there has been a northwards drift of business down Queen Street as harbourside land has been freed up and developed. But the planned Aotea Station is already driving plans for development in more southern parts of the CBD, and the improved public transport and commuter access that will be provided by Karangahape Station could also result in significant revitalisation and redevelopment around Karangahape Road and the top of Queen Street, subject to the area’s special character restrictions.

If one area within Central Auckland epitomises the evolution of inner-city living, it is Newmarket. The former borough’s population peaked as far back as 1926 at about 3,200 people, but as businesses gradually displaced residents in the CBD fringe areas, Newmarket’s population had shrunk to 1,000 by 1991. However, between the 2006 and 2013 censuses, the population almost doubled to just under 3,000. The development of more intensive housing options has brought residents back into Newmarket and will facilitate continued growth over the medium term. A similar mix of townhouses, lower-rise apartments, and mixed residential and commercial developments will underpin ongoing population growth in other comparable areas such as Eden Terrace and Parnell.

Whereas central city services in the 1990s would have been primarily aimed at workers and late-night revellers, growth in the central city population over the last 20 years means that many of the necessary amenities for residents are now in place. This relatively well-established social infrastructure means that inner-city living is a viable option for many people. Looking towards future growth, one of the biggest challenges for Auckland Council, as with other pockets of planned intensive growth across the city, will be ensuring that civil infrastructure is able to handle the increased demands placed on it by the rapidly increasing population in a relatively small geographic area.

“Newmarket epitomises the evolution of innercity living in Auckland”