Hoping for more than just sales volume growth in 2014

Growth in the volume of core retail sales (excluding the automotive sector) between June 2010 and June 2013 averaged 3.3%pa – the strongest performance since the boom times of the 2005-2008 period. But for retailers, this lift in sales volumes was hardly indicative of good trading conditions. Firstly, some of the increase in volumes was simply recovering ground lost in the wake of the 2007/08 drought and subsequent Global Financial Crisis. Secondly, the highly competitive retail environment had forced many retailers to heavily discount their products to get people in the door and to try and shift their stock.

It’s not just discounting that has driven down the prices of consumer goods over recent years. The high New Zealand dollar has put downward pressure on the prices of imported goods. Substantial quality improvements have also meant that consumers have been able to get more bang for their buck when purchasing products such as electronics. So over the last couple of years as consumers have started to feel more confident about spending again, they’ve found shopping conditions have been very much in their favour.

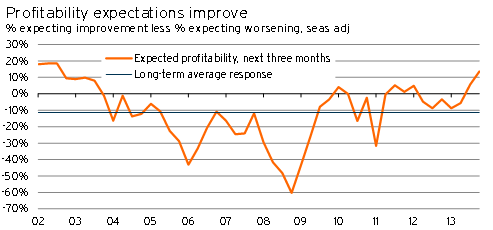

But it’s been a different story for retailers. Overcapacity in the retail sector following the boom years up until 2007 meant there were not enough customers to go around once the economy hit the wall. The increasing prevalence of online shopping, particularly with overseas-based retailers given the high exchange rate, further eroded the market share of local firms. According to the NZIER’s Quarterly Survey of Business Opinion (QSBO), the profitability of merchants at the end of 2008 was squeezed harder than at any time since 1983.

The good news is that 2014 could be the best year for retailers for some time. Notwithstanding the effects of the Reserve Bank’s loan-to-value restrictions, the strengthening housing market has been driving up sales of durable goods such as appliances and furniture. Improving job and income security are also leading to a greater ability and willingness of consumers to spend. High dairy pay-outs also represent a stimulus of over $4bn to the economy compared with last season’s incomes.

Graph 1

Merchants’ profitability expectations from the latest QSBO are at their best since 2002, with the survey also suggesting that the high-discount environment of the last few years is starting to become less prevalent. In other words, rather than simply trying to survive by trying to shift volumes at low margins, retailers should find they are able to augment volume growth with expanding margins over the next 1-2 years. Having said that, raising prices won’t be a fait accompli given the constraints posed by cheap products from overseas-based retailers.

Perhaps the biggest risk facing retailers this year is the prospect of rising interest rates and their effects on household spending. Household debt levels remain close to record high levels and, although recent growth in consumer spending has been underpinned by increasing incomes rather than taking on more debt, increasing debt servicing costs could quickly start to eat into households’ discretionary spending. If debt servicing costs significantly constrain consumers’ ability to spend, retailers may find their hopes of fattening profit margins being left unfulfilled.