Small car share plateauing

Small cars’ share of total car sales has grown substantially over recent years, but with the economy turning, large vehicles could be about to make a resurgence.

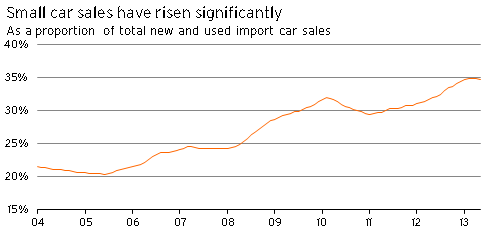

Small cars’ (less than or equal to 1600cc) share of total car sales has grown substantially over recent years. Their share is now 35% of total car sales – significantly higher than in 2005 when small car sales only represented 20% of car sales.

Small cars’ share of total car sales has been pushed higher by a combination of rising fuel prices, increased environmental awareness, and households’ reluctance to splurge on larger, more expensive, vehicles following the Global Financial Crisis. This trend has been supported by car manufacturers globally increasing the range of small cars they produce and including features in small cars that have traditionally only been available in larger alternatives. Fewer older used imports coming into New Zealand, following the introduction of new emissions standards, have also meant that only more expensive newer vehicles have been available, which has led to some car buyers switching from larger imports to slightly cheaper smaller imports.

Graph 1.1

However, over the last few months the upward march of small car sales has shown signs of moderation, as conditions in the New Zealand economy have improved significantly and households’ confidence regarding their financial position has picked up. Over the three months to May, small car sales grew by 13% from a year earlier, while growth in large car sales accelerated to 16%. This result was the first time that large car sales had grown at a faster rate than small car sales over a three-month period since February 2011. With large cars typically costing more to buy and run than their smaller counterparts, this acceleration in large car sales growth is a further sign that households’ confidence to spend is increasing again.

The remainder of this article considers how small cars’ share of total car sales may fare over the next five years, given the improved outlook for the New Zealand economy and labour market.

Small is more affordable in tough times

When purchasing a new vehicle, not only do car buyers have to worry about the price they pay for a vehicle today, but they should also consider the vehicle’s future resale value. The difference between these two prices is depreciation, and for new vehicles, annual depreciation expenses often exceed vehicle running costs.

Depreciation on large cars is typically a lot more than depreciation on smaller vehicles because large cars cost more to begin with and often have a relatively poor resale value. With households’ incomes and balance sheets having taken a significant hit following the Global Financial Crisis, losing large sums of money in the form of depreciation has been a rather unappealing prospect for many households over recent years.

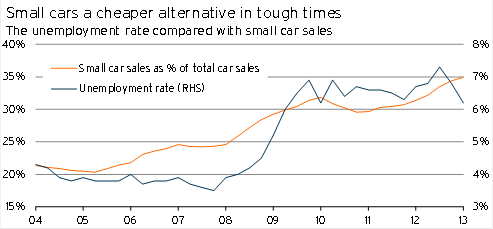

From a low of 3.5% in December 2007, New Zealand’s unemployment rate has risen to as high as 7.3% in September 2012. From Graph 1.2, it is clear that this deterioration has coincided with a trend of rising small car sales. This trend may be partly explained by the fact that households compromised and bought smaller vehicles over the last few years while they were uncertain about their financial positions.

Graph 1.2

Over the next five years, we expect GDP to grow by an average of 3.0%pa, significantly faster than the average growth of 1.0%pa over the past five years. With economic conditions improving, so will the labour market. By mid-2016, we expect the unemployment rate to have fallen below 5%, from its current level of 6.2%. In this environment, households’ tolerance for depreciation on cars may rise, which would dampen the prospect of further upward pressure on small cars’ share of total car sales.

Small car allure grew as fuel prices rose

Aside from depreciation and regulatory compliance, running costs for well-maintained vehicles are dominated by fuel prices. When households’ balance sheets are in good condition, car buyers are prepared to spend a little bit more on fuel. However, when times are tougher, car buyers tend to reduce their fuel bill wherever possible. With small vehicles typically being a lot more fuel-efficient than their larger counterparts, demand for small cars often rises during prolonged periods of increasing fuel prices – particularly when this fuel price pain is coupled with financial uncertainty.

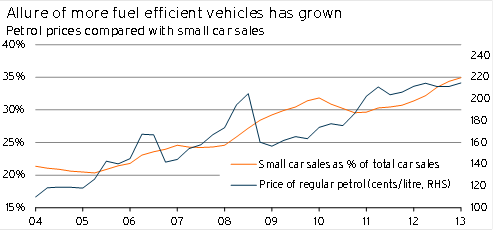

Between March 2004 and March 2013, petrol prices increased by 96%, while over the same period, general consumer prices only rose by 27%. Not surprisingly, this sharp increase in the real price of petrol corresponded with the rebound in small car sales, as households sought to minimise their fuel bill by getting more fuel-efficient vehicles.

Graph 1.3

Although we expect fuel prices to remain elevated in real terms over the next five years, the substantial upward march in prices is forecast to be at an end.

Furthermore, we anticipate that demand for small cars on fuel-efficiency grounds will ease. Behind this belief is the observation that fuel efficiency of larger vehicles is improving more rapidly than for smaller vehicles. Data from NZTA’s 2012 annual Fleet Statistics report shows that between 2007 and 2012, the fuel efficiency of small petrol vehicles improved by an average of 5.0%, while over the same period large petrol vehicles became 10.2% more fuel efficient on average. A similar pattern was also seen with diesel-powered vehicles. This trend can be attributed to factors such as the increased use of composite materials to reduce vehicle weight and improved engine technology – including a greater prevalence of hybrid engines.

Conclusion

With the outlook for households’ employment prospects and financial positions perking up, and the fuel efficiency of larger vehicles rapidly improving, our central view is that small cars’ share of total car sales will plateau over the next five years.

However, this conclusion is not without risks. Potential downside risks to small cars’ share of total sales are that the labour market could show a more rapid improvement than we have factored in, or that fuel prices ease significantly in real terms.

On the other hand, upside risks stem mainly from the prospect of regulatory intervention. One potential scenario is that RUC concessions are given to users of small diesel-powered cars to recognise their low emissions levels and the relatively small amount of wear they put on roads. Another scenario is that emissions standards for used Japanese imports are tightened further at some point, which could push the prices of some larger imported used cars out of the budget limits of some households.