390,000 Airbnb guest nights in Auckland, 180,000 in Queenstown

Airbnb’s explosive growth has been integral in helping to ease accommodation bottlenecks in the New Zealand tourism sector over the past year. There are now around 20,000 listings on Airbnb in New Zealand and hosts earned a total of $55m over the March 2017 year.

This article profiles the market position of private accommodation provided through Airbnb in New Zealand’s two biggest visitor destinations, Auckland and Queenstown. It also argues that private accommodation, provided through peer-to-peer (P2P) platforms, needs to be embraced as part of the solution to managing peak load in the New Zealand tourism sector.

How big is Airbnb in New Zealand’s key visitor hotspots?

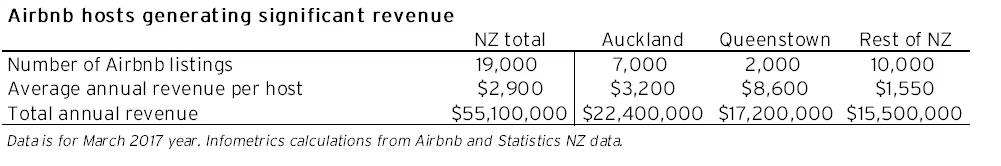

Of the $55m spent on Airbnb accommodation in New Zealand over the past year, $22m was spent in Auckland and $17m was earned by hosts in Queenstown-Lakes District. In other words, more than 70% of the earnings generated using Airbnb was in Auckland and Queenstown-Lakes.

Looking more closely at other statistics provided by Airbnb shows that the typical host in Queenstown-Lakes earns a higher average yield ($8,600 per annum) than Auckland hosts ($3,200pa).

But Infometrics calculations in the following table shows that both destinations are higher yielding than other parts of New Zealand (just over $1,500pa).

Table 1

The number of Airbnb listings in Queenstown-Lakes is incredible when one considers that there are only around 20,000 dwellings in the district. Sure, some dwellings may have multiple Airbnb listings, but even so, Airbnb’s claim of 2,000 listings translates to about 10% of Queenstown-Lakes’ dwelling stock. By comparison, Auckland’s 7,000 listings represent approximately 1.3% of the 540,000 dwellings in our biggest city.

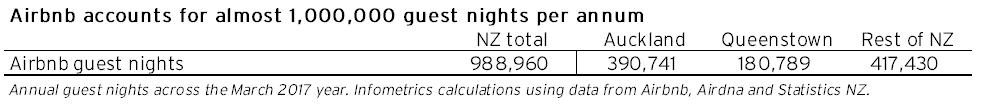

We have also estimated how many Airbnb guest nights there were over the past year.

Taking the total revenue estimates outlined above, in conjunction with average Airbnb listing prices per effective room (calculated using data from Airdna) and the assumption that occupancy per room is similar to commercial accommodation, we found some startling results.

Over the year to March 2017, we estimate that there were just under 1,000,000 Airbnb guest nights in New Zealand. Of these guest nights, almost 200,000 were in Queenstown-Lakes, while just over double that were in Auckland.

These results are summarised in the following table.

Table 2

And remember Airbnb isn’t the only place to find private accommodation. There are several other P2P platforms providing private accommodation in New Zealand, such as Bookabach and Holiday Houses.

However, these companies are understandably cagey to release commercially-sensitive data on their market positions. As a result, it is difficult to gauge how much more other P2P accommodation providers add to guest nights.

How big is Airbnb compared to commercial accommodation?

Having now established what each host makes and the size of Airbnb’s footprint in New Zealand, it is interesting to put these estimates alongside the commercial accommodation sector. This step enables us to get a feel for how many people are choosing Airbnb over hotels, motels, and other traditional options.

Airbnb adds a lot to accommodation capacity

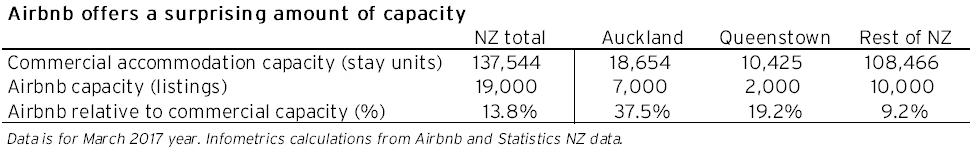

If, on any given night, all Airbnb hosts were willing to let out their rooms, then the 19,000 listings would compare to an average of 137,544 commercial stay units that were available each night during the March 2017 year.

In percentage terms, the number of Airbnb listings was equivalent to 14% of the size of the commercial accommodation sector at a national level. This proportion was even higher in Queenstown-Lakes (19%) and Auckland (38%), while in the rest of New Zealand the proportion was only 9.2%.

Table 3

But less so in terms of guest nights

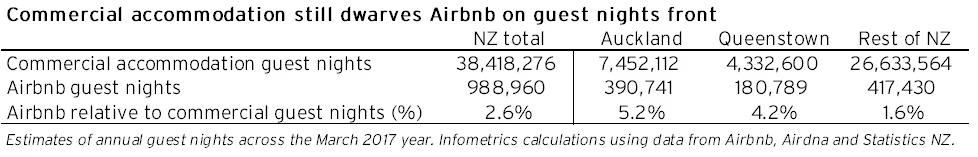

But Airbnb’s relative size appears much smaller when you work out how total Airbnb guest nights stack up against commercial accommodation guest nights.

The following table shows that total Airbnb guest nights are equivalent to just 2.6% of the commercial accommodation total in New Zealand. Even in Auckland and Queenstown these proportions are just 5.2% and 4.2% respectively.

Table 4

Because Airbnb hosts have different expectations

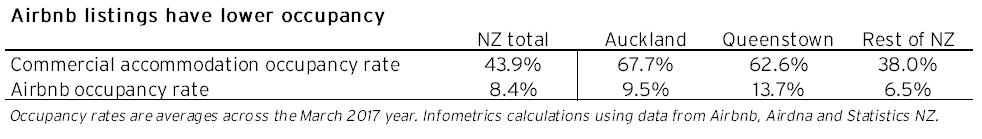

The reason for Airbnb having a smaller relative number of guest nights is due to lower occupancy rates. The average Airbnb host isn’t necessarily looking to have visitors year-round. Instead hosts may only be filling up spare rooms at peak times, or renting out their house periodically when they are out of town. By comparison, commercial operators are always aiming to fill their rooms to maximise their return on investment.

The following table summarises these differences in average occupancy rates for Airbnb compared to commercial accommodation providers over the March 2017 year.

Table 5

P2P accommodation needs a seat at the big kids’ table

The results in the previous section show that, while small, Airbnb is having a significant nibble around the edges of the tourism sector. And judging by the barrage of complaints I have seen in the media, commercial accommodation providers don’t like it one bit. The question now is where to from here?

Clearly hotels, motels, and other commercial options will always play a key role in New Zealand’s visitor infrastructure. But it is about time that P2P accommodation platforms like Airbnb are embraced as a sensible part of the solution to carefully managing future growth in the tourism sector.

Make use of underutilised space

Solely putting focus on constructing new commercial accommodation is not necessarily the most efficient way to accommodate visitors. After all, hotels are an extremely capital intensive investment and, apart from peak summer months, have relatively low occupancy the rest of the year.

Private accommodation, on the other hand, makes use of an accommodation resource that is already there, but is simply underutilised. By matching this underutilised housing, with paying guests, P2P accommodation providers are allowing New Zealand to leverage up its housing return and more efficiently make use of capital.

Many New Zealanders have spent way too much money on housing, so why not accept them using the asset productively as being a sensible choice?

Acknowledge self-regulation practises of P2P accommodation

The problem is that P2P accommodation providers are treated to a predictable chorus of complaint from the commercial accommodation sector who argue an unregulated market place will deliver inferior experiences.

But these complaints have little substance.

P2P providers already self-regulate themselves, with a peer reviewing system that effectively pushes private households into ensuring they deliver a quality experience. If someone gets bad reviews, either they will need to lift their game, or the market will squeeze them out.

Hardwire private accommodation hosts into the tourism network

Key stakeholders in the tourism sector, such as visitor experience operators, regional tourism organisations, and government departments (such as MBIE) could also work together to draw up a framework for supporting private accommodation providers.

For example, regular regional training workshops could be run for households looking to list via a P2P accommodation provider that focus on what is needed to offer a high standard of service to visitors. A key part of this training would also be ensuring that households had access to local resources, so that they could assist their guests in knowing what range of visitor activities were on offer in their area.

Instead of fighting a movement that is already making a valuable contribution to the New Zealand economy, the tourism sector needs to get over itself and extend an olive branch to P2P accommodation providers.

Like it or not, private accommodation is here to stay.

It’s time that stakeholders in the tourism sector invite P2P accommodation providers to have a seat at the big kids’ table.