Federal Reserve reducing stimulus as US economy picks up

With the US economy strengthening, the Federal Reserve has recently begun tapering its quantitative easing programme. In this article we look at how quickly the US looks set to recover, and what this outlook means for quantitative easing and interest rates in the United States.

The US economic recovery continued to strengthen in 2013, with economic activity rising by 1.9%pa over the year and the US unemployment rate falling from 7.9% in January 2013 to 6.6% by January 2014. Despite drag from fiscal spending austerity and the federal debt ceiling fiasco, rising consumer spending and investment levels (particularly in housing), coupled with strengthening export activity, ensured that the economic recovery stayed on track.

The improvements to the US economy and labour market to date have convinced the Federal Reserve to begin tapering its quantitative easing programme. In January, the Fed announced that it was cutting bond purchases by US$10bn per month to a rate of US$65bn per month. This was the second US$10bn cut since the Federal Reserve began the tapering process in December last year.

Putting it all in perspective

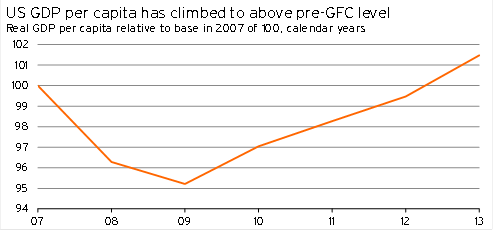

The US economy was hit hard in the wake of Lehman Brothers’ collapse during the Global Financial Crisis. Over the two years to December 2009, real GDP per capita in the US fell 4.8% from its 2007 peak.

However, the US economy began to recover thereafter, in part thanks to extraordinary intervention from the US Federal Reserve. We estimate that the growth in economic activity that occurred during 2013 was sufficient to finally push economic output per US citizen above its pre-GFC level.

Graph 5.28

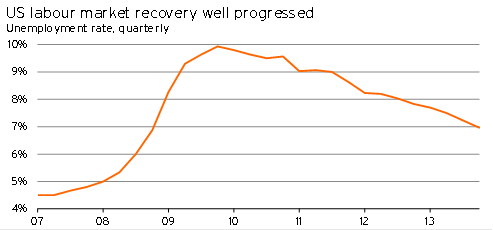

The US labour market was also hit hard during the GFC, with the unemployment rate rising from around 4.5% throughout much of 2007 to a peak of 10.0% in October 2009. However, as economic conditions over the past four years slowly improved, the unemployment rate has fallen significantly, reaching 6.6% in January 2014.

Graph 5.29

In this environment of strengthening economic and labour market conditions, there has been pressure for greater wage increases, particularly among lower-paid workers. A bill has recently been passed to raise the raise the federal minimum wage from US$7.25 to US$10.10 an hour over three years.

The outlook for Federal Reserve tapering

We are forecasting that US economic growth will accelerate in 2014, with growth reaching 3.0%pa for the first time since before the GFC. We anticipate that economic growth will then average 3.1%pa during 2015 and 2016. The key driver of the recovery will be a further strengthening to consumer spending and investment levels, as household confidence levels rise in line with improving job prospects and recovering house prices.

With economic conditions looking up, the Federal Reserve will continue tapering its quantitative easing programme throughout 2014. As long as there are no further stumbles for the economic recovery, we anticipate that by the end of 2014, the Fed will have fully wound up its bond-buying programme.

Even with the Fed scaling back quantitative easing, the Fed’s target interest rates remains close to zero. Outgoing Federal Reserve Chairman Ben Bernanke confirmed in his final statement that the Fed intends to keep interest rates close to zero until well after unemployment falls to 6.5%. With the unemployment rate already at 6.6%, this would seem to imply that interest rate rises could occur quite soon.

At this stage, we are picking that interest rates won’t start rising until mid-2015.

- The participation rate in the US is at a 30-year low of 63%, down from 66% before the GFC. Much of the low participation rate can be put down to discouraged workers, and it implies that the unemployment rate on its own is a poor indicator of when to tighten monetary settings.

- The Fed needs to cut its bond purchases to zero, then let a lot of the bonds on its balance sheet mature (or be sold), before it can look to raise interest rates. Although the process of maturity is likely to be pretty quick, it is still likely to be the end of 2014 before the fed has completely finished its programme of quantitative easing.

- There has been a slowdown in partial indicators of the US economy over December and January. This softening was in part due to snowstorms, but with indicators also slowing in Asia, there are possible downside risks to economic growth in the near term. If the data stays weak in the coming months, the Federal Reserve will respond by delaying tapering, thereby pushing out the timing on interest rate rises as well.