The loss of international tourism has seen dairy regain its position as New Zealand’s largest export. Among the upheaval of COVID-19 in 2020, New Zealand’s primary sector has held up well, providing high-quality food and beverage products to both the local and overseas markets.

Although the dairy sector has helped boost regional economies over the last year, dairy growth has been more muted of late, and over the year to March 2020 (prior to COVID-19) fell.

The march of the cows reaches peak cow

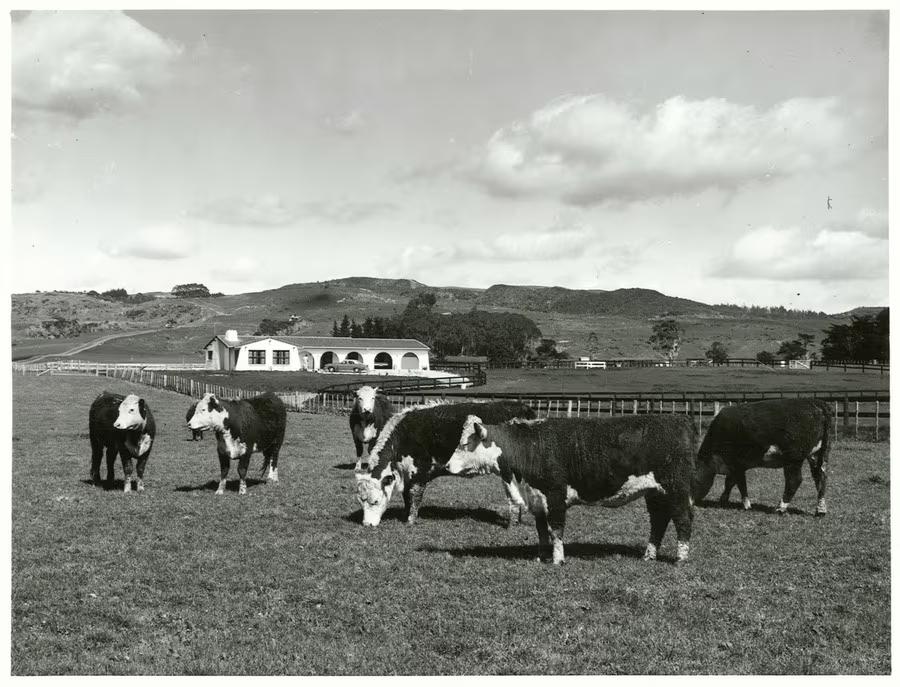

New Zealand’s dairy sector has come through a remarkable period of expansion over the past twenty years. The number of dairy cows grew from 3.4m in 2000 to 4.9m in 2019, with the greatest increases taking place in Canterbury and Southland (see Map 1).

Underpinning this growth has been a continued increase in intensity and efficiency. Over the last twenty years, the area being farmed for dairy grew 33% and the number of cows per effective hectare grew from 2.67 to 2.84.

As farms were merged to achieve greater scale, the average herd size has nearly doubled, from 251 in 2000 to 440 in 2019. This consolidation in dairy activity is borne out in the change in the number of business units, which has decreased by 28%.

However, dairy cow numbers have been relatively flat since the 5.0m peak in 2015, easing back slightly to 4.9m cows in 2019 (see Chart 1). It appears that this 5.0m mark represents ‘peak cow’ – more on that later.

Coming out of a challenging season…

We’ve recently updated our Regional Economic Profile with data up to March 2020. This update highlights just how challenging the year to March 2020 was for the dairy sector, with severe drought (particularly in Northland) and higher feed prices denting profitability. Dairy farming GDP fell 3.9% over the year to March 2020, and GDP from dairy product manufacturing only grew by 0.2% (see Chart 2).

The fall in dairy cattle farming GDP weighed heavily on overall GDP for a number of dairy-intensive districts such as Clutha, Southland, Waikato and South Taranaki.

…and walking straight into COVID-19

COVID-19 has challenged all corners of the economy, dairy included, but with “essential services” status, the dairy industry has managed fairly well through 2020. The value of our dairy exports largely held up through the year, although there has been a softening of prices in recent months (see Chart 3). Unlike our meat and seafood exports, our dairy products tend to be consumed in-home, meaning that the closure of restaurants during COVID-19 lockdowns overseas hasn’t dampened demand.

A renewed focus on health and building immunity may have helped our dairy exports, with calls in China to boost milk consumption, including the idea for a national strategy to “encourage every person to drink at least 300 grams of milk a day”. Getting our exports out of the country is likely to be the biggest challenge for dairy at the moment.

No more growth left in the tank

The dairy industry’s extended growth march is heading straight into a wall of regulation, which laudably seeks to mitigate the negative effects of intensive agriculture on the environment. The Essential Freshwater package seeks to reduce runoff of sediment and nutrients into waterways and protect wetlands, which will be achieved by reducing farming intensity and reducing the area being farmed. These changes are potentially very significant, with conservative estimates for Ashburton District suggesting an 80% reduction in farm profitability.

On top of these water standard changes, inclusion of agriculture into the emissions trading scheme from 2025 onwards will add further costs to the industry. Given this outlook, further investment in farm conversion or intensification seems unlikely.

The challenge of reduced profitability for dairy also presents a great opportunity to explore different land uses with a lower environmental impact. For example, the country’s first oat milk factory is in the pipeline for Southland, to support expansion of oat growing and development of high value added exports.