How much further does the migration surge have to run?

Net migration has surged well above the outlook we provided in our July forecasts, and looks set to keep outperforming over the coming years.

Net migration has surged in recent months, confounding our expectations of a more managed increase in inflows. In the three months to August there was a permanent net inflow of 6,290 people (seasonally adjusted). If the current rate of migrant inflows was sustained, annual net migration would be above 25,000pa!

In this article we dig into the main causes of this sudden lift in net migration – a relatively weaker economic outlook for Australia and a surge in permanent non-citizen arrivals.

The Australian story

The biggest surprise for our net migration forecasts has been the swift turnaround in net flows to Australia.

In the year to August, net migration outflows to Australia fell to 27,252pa, down from 39,956pa in August 2012. On a monthly basis, net migrant outflows have fallen sharply – with the net 1,140 people leaving in August the lowest monthly number since November 2009 (seasonally adjusted).

In our July forecasts, we had anticipated that some New Zealand citizens would be returning from Australia. Many of the factors behind the decline in the Australian economy were known at the start of the year – domestic demand was weak, and the mining-related binge in investment was giving way. These reasons have contributed to the Reserve Bank of Australia’s cuts to its cash rate target.

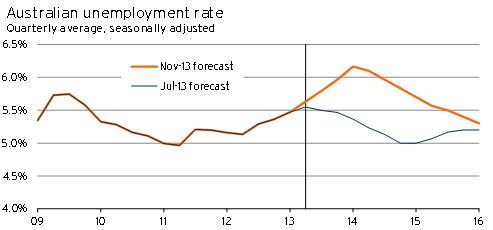

However, the Australian unemployment rate has risen more sharply than we’d previously expected. And given the pessimism expressed in recent consensus forecasts for Australia, unemployment looks set to keep rising for longer than we had allowed for in July.

Graph 5.9

Unfortunately, the stalling of growth in manufacturing output in China was both larger and more persistent than had been anticipated. As a result, the Australian economy and the Australian labour market have underperformed.

So even with Chinese economic activity starting to gather a new head of steam, and with the Reserve Bank of Australia cutting the cash rate further, the unemployment rate is not expected to peak until early 2014 – at a 12-year high of 6.2%.

Although the weaker outlook in Australia is the key driver of the shift in net migration, it isn’t the only factor. The outlook for the New Zealand labour market has also improved.

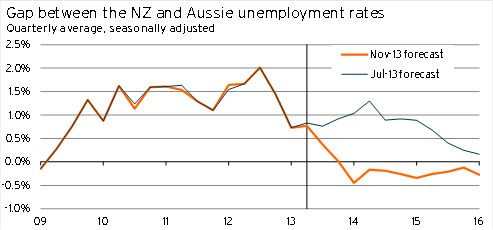

Of the decrease in the gap between the Australian and New Zealand unemployment rates, higher unemployment in Australia accounts for around two-thirds of the decrease relative to our July forecasts, while a lower New Zealand unemployment rate accounts for around one third of the change. A shrinking gap between the two unemployment rates implies that relative employment conditions in New Zealand have improved.

Graph 5.10

Does the unemployment rate have a big impact?

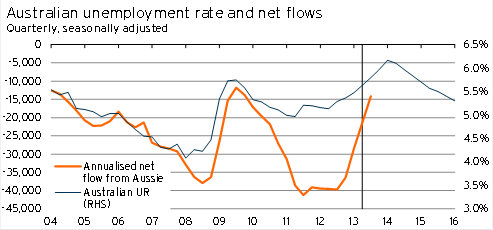

Our forecast of net migration flows to Australia and, as a result, a large part of our total migration forecast, is based on these views about Australian unemployment and the “unemployment gap” between our two nations.

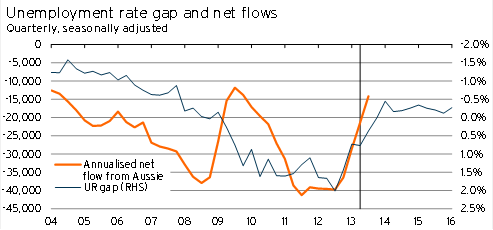

Graph 5.11 and Graph 5.12 illustrate that, although both the Australian unemployment rate and the unemployment rate gap bear some relationship to migration flows between New Zealand and Aussie, they are far from perfect predictors. Combining these two factors provides a significant amount of information about the movements in migration flows between the two countries, but does not provide a full explanation. The decision regarding whether to move to Australia, stay in New Zealand, or move from Australia to New Zealand has three other characteristics we try to account for.

- The first is employment opportunities or employment growth. Although the unemployment rate data captures a lot of the shift in employment and employment opportunities, employment options can be influenced by other circumstances as well. Specifically, the Canterbury rebuild is offering very sector-specific demand for labour, which implies relative employment opportunities may be better in New Zealand than the unemployment rate represents.

- The second factor to include is the link between departures and arrivals. Going to Australia to try to find work is, for some, an experiment. If it doesn’t pan out, people come back. At the moment, this link implies that the strong departure numbers we’ve had throughout 2012 are boosting arrivals from Australia now.

- The third factor is relative incomes. The high wages on offer in Australia were undeniably a driver of high outflows. With some of this gap likely to close (see Chinese rebalancing: NZ to outperform Aussie?), there will be a little less of an incentive for New Zealanders to head to Australia to chase the big bucks.

Graph 5.11

Graph 5.12

In overall terms, these factors are expected to hold down net outflows to Australia during the next three years, relative to what the unemployment figures would otherwise indicate.

Can stronger non-citizen arrival numbers last?

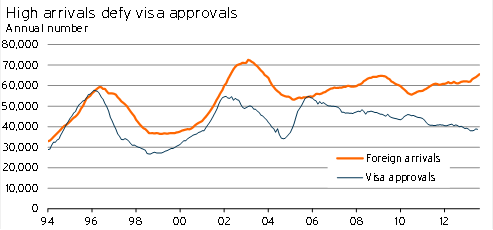

The other main driver of the sharp upswing in net migration inflows in recent months has been permanent arrivals of foreign citizens into New Zealand. In the year to August, non-citizen arrivals to New Zealand rose to 60,919 people – the largest number of arrivals since October 2003.

The strong lift in foreign citizen arrivals is surprising given the weakening in visa approvals – not just recently, but over the past three years.

Graph 5.13

Although, on the face of it, this observation is surprising, Graph 5.13 shows that there have been prolonged periods where the trend in visa approvals and the trend in foreign citizen arrivals have diverged sharply. In fact, during the surge in net migration between 2002 and 2004 there was a similar-sized divergence.

However, unlike that period we do not believe the current divergence can be sustained. In 2002/03 there was a large stock of visa applications “on-hand” – these are applications that have not yet been approved, but which are fairly likely to be given a tick. In July 2003, there were 59,905 visas at this stage.

In July 2013, the stock of visa applications on hand is significantly smaller, at just 28,887, having been run down persistently over the past couple of years. These figures imply that:

- the “stock” of potential non-citizen migrants is likely to be relatively small

- MBIE will easily be able to cut back visa approvals if they are concerned about net migration inflows getting too large.

As a result, we do not believe it is sustainable for foreign citizen arrivals to remain at their current elevated level over the next three years. Our forecasts are based on foreign citizen arrivals peaking at around 67,000pa in the first half of 2014, and then easing back to around 62,000pa by late 2015.

In terms of migration inflows, there is a risk that true permanent arrivals will not only exceed our forecasts, but will exceed the actual measures provided by Statistics NZ. This outcome occurred during the 2002-2004 period, leading to a significant upward revision in the estimated population following the 2006 census.

The primary nationalities that are likely to boost these figures are from visa-waiver nations1, especially the United Kingdom and Australia. It is relatively easy for residents from these other nations to come to New Zealand for a working holiday, and then deciding they like it so much that they stay permanently. There are two main areas we would expect to see signs of this “category jumping” if it does start to occur.

- The earliest warning would come in the tourist arrival figures, and other related tourism surveys. Some of the rising tourist arrivals from visa-waiver countries would potentially signal greater permanent migration.

- We would also expect to see a lift in residence applications and approvals for visas from within New Zealand.

Although these two measures are not ringing any alarm bells yet, we will continue to keep a close eye on them.

Conclusion

Net migration inflows have blown our forecasts out of the water – with a weaker Australian economy and a genuinely surprising lift in foreign-citizen arrivals from other countries behind the migration spike.

Given our updated view about the Australian economy, we have strongly revised up out net migration forecast for the next three years.

Nevertheless, we expect net migration to peak during 2014 and steadily come down. A major driver of this change will be a moderation in foreign-citizen arrivals. We believe foreign-citizen arrivals are currently at an unsustainably high level given the rate of visa approvals and the visa applications on hand at the New Zealand Immigration Service.

There is a risk that, even if observed net migration does run in line with our forecasts, actual net migration (and therefore population growth) may be stronger. This outcome would occur if individuals and family coming in on temporary visas (or through visa -waiver programmes) decide they want to stay permanently. As a result, we will be keeping a careful eye on resident visa applications and temporary visitor arrival numbers to gauge this risk going forward.