Articles

Budget 2025 was delivered amid a backdrop of rising global uncertainty, dragging broader economic expectations lower and making fiscal settings more constrained. Domestic economic activity is still set to recover, but Budget 2025 also reinforced views that the government will be less of a driving force for this recovery, as more focus is shifted to households and the private sector to rev up New Zealand’s economic engines. Read

Chief Forecaster Gareth Kiernan has penned Infometrics’ traditional Christmas Carol. Sung to the tune of Perry Como's Christmas song “It's beginning to look a lot like Christmas”. Read

With Budget 2024 fast approaching, there’s a lot more focus on tax than before. The coalition government has vowed to deliver tax relief to most households, although the final design and cost of the tax package is yet to be revealed. Read

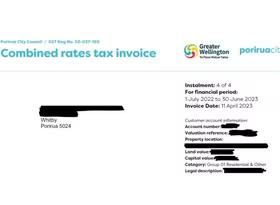

New analysis from Infometrics, first released to Infometrics clients last week, shows that returning the GST charged on local council rates back to councils would cost the government $1. 1b. Read

Principal Economist, Brad Olsen, examines rising local government costs. With expectations that rates rises in 2024 will be the largest since local council reforms in 1989... Read

The government’s plans to fully deliver its promised tax cuts at next month’s budget must be in doubt, as the economy falters and the fiscal position continues to get squeezed. Compared to the government’s 2023 Budget, the deficit is tracking to be $1.8b larger than forecast. Read

In New Zealand’s laissez-faire economy, there are two main institutions with the ability to have a significant effect on economic outcomes. One of those institutions, the Reserve Bank, attracts plenty of attention and generates its fair share of column-inches with its monetary policy decisions. But it’s debatable ... Read

The New Zealand economy has entered the new year with questions about whether the worst of the post-Covid hangover is behind us, or whether there’s more of a slowdown to come in 2024. We have collected our thoughts on three issues that will play a key role in determining New Zealand’s economic performance this year. Read

Chief Forecaster Gareth Kiernan has penned Infometrics’ traditional Christmas Carol. Sung to the tune of Tommie Connor's Christmas song “I Saw Mommy Kissing Santa Claus”. Read

The final vote counts and seat allocations from the election will be released this Friday, confirming whether NZ First is part of the next government and, if so, how much power they have. Although formal coalition talks have yet to begin, more informal conversations between the parties are ongoing, and National will already be compiling the key policies to feed into its expected mini-Budget in December. Given the issues that were dominating voters’ thinking in the lead-up to the election, what might be at the top of the new government’s to-do list? Read